Restaurant Revitalization Fund Information

Registration for the Restaurant Revitalization Fund (RRF) is now open. Click here to register. If you are working with Square or Toast, you do not need to register. The American Rescue Plan Act established the Restaurant Revitalization Fund to provide funding to help restaurants and other eligible businesses keep their doors open.

The Baker County Economic Development Director, the Baker City Manager, Baker County Chamber, and the Oregon Small Business Development Center have taken the lead in coordinating recovery efforts within Baker County. We are working in tandem with the Baker County Emergency Operations Center. As this crisis evolves, we will attempt to coordinate any aid that may be forthcoming from State, Federal and other entities.

If you have questions regarding the Guidelines, please contact us by phone at 541-523-0015 or by email at EOC@bakercounty.org. If there is no answer or you have called after normal business hours, please leave a message and your call will be returned as soon as possible. Also, if you have additional questions, you can contact our local Oregon Small Business Development Center thru Blue Mountain Community College at 541-406-4770 or jnelson@bluecc.edu or www.BizCenter.org.

Free Masks and Gloves for Small Businesses

Governor Brown announced a new program to provide masks and gloves to small business in the midst of the COVID-19 pandemic. The Governor, in partnership with the Oregon Legislature’s Emergency Board, allocated $10 million from the federal CARES Act funding for the purchase of protective supplies. The state of Oregon is fulfilling orders at no charge until resources are depleted.

Businesses with fewer than 50 employees that are headquartered in Oregon with principal operations in Oregon are eligible. Business Oregon — the state’s economic development agency — and the Department of Administrative Services are collaborating to create the order and distribution process. Businesses with fewer than 10 employees will receive a box of 200 gloves and 100 masks, with larger businesses receiving up to 500 masks and 800 gloves. For now, businesses are limited to one order, with additional orders possible at a later date depending on availability.

In addition to the small business program, the Early Learning Division (ELD) is providing supplies such as gloves, disinfecting wipes, masks and more to child care providers around the state as part of the effort. The Governor set aside $1.3 million from the federal Governor’s Education Emergency Relief Fund to purchase supplies for this critical service. Child care providers have been operating under emergency conditions since March and are following increased safety and health guidelines. Child care providers approved by ELD to operate Emergency Child Care are eligible to order supplies and will need a license/provider number to do so.

The order form is online and is now accepting orders. Businesses and child care providers can access the form here: https://supplyconnector.org/states/oregon/free-ppe/

Homeowner and Renter Information:

The federal government has created a new one-stop website for homeowners and renters seeking guidance about housing options during the COVID pandemic. Previously, individuals seeking this kind of information were forced to cobble it together from multiple agencies with multiple roles in the housing ecosystem. The website aggregates info from HUD, the CFPB, and the Federal Housing Finance Agency (essentially the GSEs).

Farmer and Rancher Information:

Quarantine relief fund for farmworkers: Farmworkers who need to quarantine may qualify for the Quarantine Fund, which provides financial support of up to $ 1,290 to farmworkers who have been exposed to COVID-19 at work or at home and who quarantine for three weeks (21 days).

Who is eligible to apply to this fund? Oregon agricultural workers, 18 years of age or old, who: have had exposure to COVID-19 for which self-quarantining is recommended; are practicing self-quarantining; and are seeking health care assistance during the period of self-quarantine. Call 1-888-274-7292 to apply for this fund. More information is available on the Oregon Worker Relief Fund website.

USDA information to assist farmers and ranchers impacted by the pandemic with the Coronavirus Food Assistance Program (CFAP) can be found here.

The PPE supply connector database is well populated and should be up and running next week. It will likely be hosted on the navigator website and allow Oregon businesses needing PPE to reopen to source it directly from a list of manufacturers able to provide it. Should be a great resource for Oregon businesses needing supplies to operate safely.

A recent report from the SBA Inspector General identified a deficiencies in the rollout of the CARES Act programs, including failing to prioritize rural and underserved markets, inadequate guidance on loan forgiveness, and the need for additional info about loan deferment. It suggested the SBA take action to remediate these concerns.

In a revised FAQ issued May 13, SBA confirmed that PPP borrowers with loans under $2 million will be deemed to have made in good faith the required certification concerning the necessity of the loan. According to the FAQ, businesses with loans below this level are ‘less likely to have had access to adequate sources of liquidity’ than borrowers that obtained larger loans.

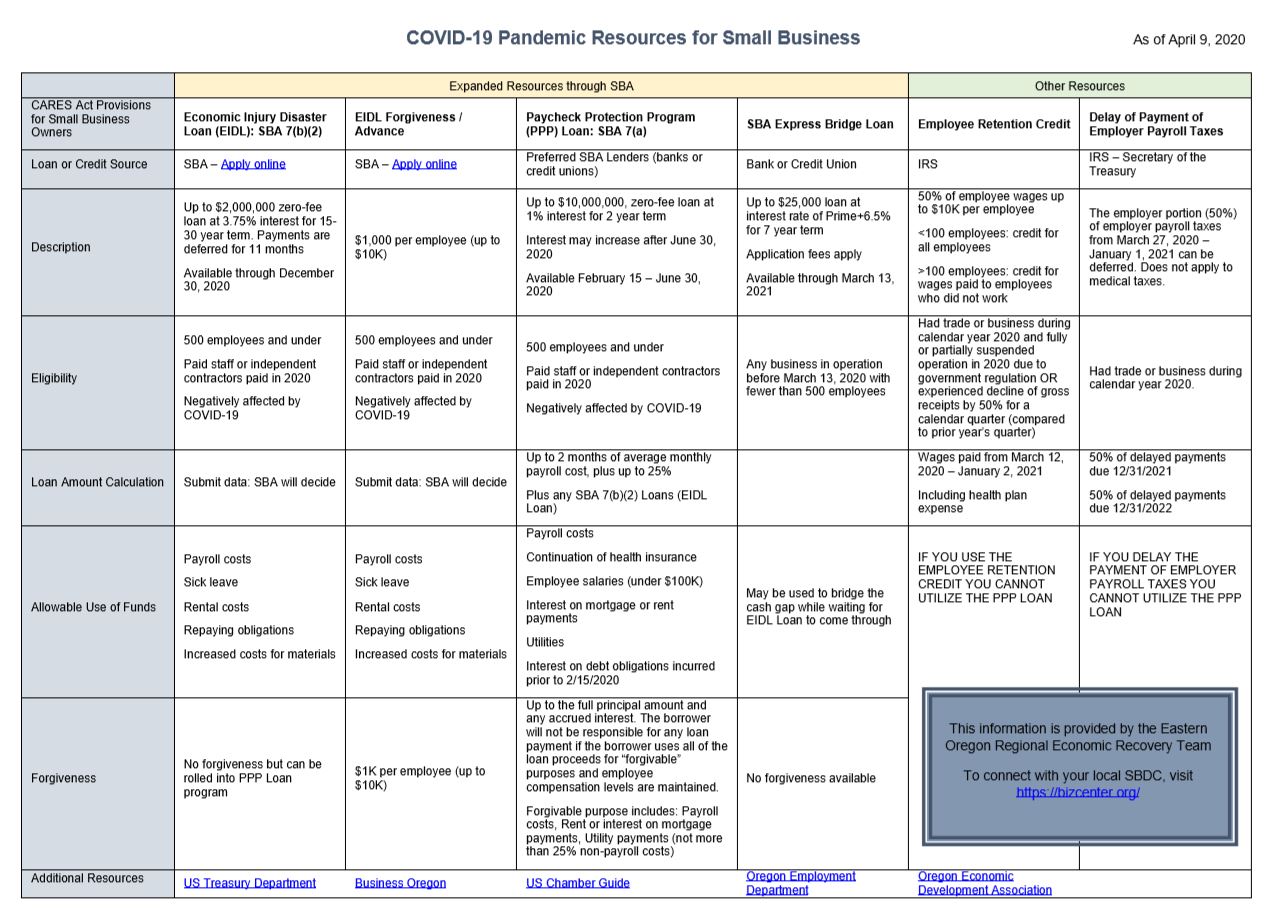

Eastern Oregon Economic Recovery

Federal Resources for Small Businesses

Finimpact’s Small Business Survival Guide to combat COVID-19

Paycheck Protection Program and Economic Injury Disaster Loan Updates:

SBA is unable to accept new applications at this time for the Paycheck Protection Program or the Economic Injury Disaster Loan (EIDL)-COVID-19 related assistance program (including EIDL Advances) based on available appropriations funding. EIDL applicants who have already submitted their applications will continue to be processed on a first-come, first-served basis.

The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $349 billion toward job retention and certain other expenses.

Small businesses and eligible nonprofit organizations, Veterans organizations, and Tribal businesses described in the Small Business Act, as well as individuals who are self-employed or are independent contractors, are eligible if they also meet program size standards.

Under this program:

- Eligible recipients may qualify for a loan up to $10 million determined by 8 weeks of prior average payroll plus an additional 25% of that amount.

- Loan payments will be deferred for six months.

- If you maintain your workforce, SBA will forgive the portion of the loan proceeds that are used to cover the first 8 weeks of payroll and certain other expenses following loan origination.

A Paycheck Protection Program fact sheet can be obtained here.

The U.S. Small Business Administration Economic Injury Disaster Loans and Loan Advance allows small business owners in all U.S. states, Washington D.C., and territories are eligible to apply for an Economic Injury Disaster Loan advance of up to $10,000.

The SBA’s Economic Injury Disaster Loan program provides small businesses with working capital loans of up to $2 million that can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. The loan advance will provide economic relief to businesses that are currently experiencing a temporary loss of revenue. Funds will be made available within three days of a successful application, and this loan advance will not have to be repaid.

Small Business Association Programs

Here is a helpful video about the programs:

July 2021 Archives

COVID-19 Emergency Response Grant Program Opens May 11

In an effort to support entities that have direct ties to driving overnight visitation, Travel Oregon is pleased to announce its COVID-19 Emergency Response Grants Program will open for applications on Mon., May 11. Program applications may be used for general operating support with the goal of maintaining jobs. Continued operations of small businesses and regional and destination marketing/management organizations will be vital to the travel and tourism industry’s economic recovery efforts. Total funding available for the program is $800,000. Grant awards will be announced on Wed., June 3. Read the complete Grant Guidelines to see eligibility requirements, funding parameters and application questions. Learn more. Please direct questions to grants@traveloregon.com.

We will be entering into Phase 2 on June 6 in Baker County. We have included the Guidelines as authorized by the Oregon Health Authority and the Governor of Oregon below. We are attempting to keep this list as current as possible to assist Businesses. If you would like assistance in participating in any of these programs or have questions regarding the Guidelines, please contact us by phone at 541-523-0015 or by email at EOC@bakercounty.org. If there is no answer or you have called after normal business hours, please leave a message and your call will be returned as soon as possible. Also, if you have additional questions, you can contact our local Oregon Small Business Development Center thru Blue Mountain Community College at 541-406-4770 or jnelson@bluecc.edu or www.BizCenter.org.

State of Oregon Reopening Guidelines

The State of Oregon has released the following reopening guidelines for different business sectors. Baker County has entered Phase 2 of reopening, and is in the process of submitting a plan for Phase 3 to the Governor’s Office and is awaiting approval after the 21 days. These guidelines will be updated as new information becomes available.

You will find all of the State of Oregon’s Guidelines here: https://govstatus.egov.com/or-covid-19/

April 2021 Archives

During these live webinars we will discuss:

· What is the Restaurant Revitalization Fund

· Who is eligible to apply

· How much money you can get

· How funds can be used

· How and when to apply

· Where to get help with your application

SBA Seattle district staff will answer your questions live throughout the presentation and with dedicated Q&A time at the end.

Webinar Schedule:

Friday, April 23

9 – 10 a.m.

1 – 2 p.m.

Monday, April 26

9 – 10 a.m.

2 – 3 p.m.

Wednesday, April 28

9 – 10 a.m.

2 – 3 p.m.

Friday, April 30

9 – 10 a.m.

2 – 3 p.m.

May 2020 Archives

Baker County Phase II Business Q & A on June 10, 2020, from 4-5 p.m.

To participate in this Q & A, please use the following link: https://us02web.zoom.us/j/84604553897

As we enter into Phase 1 of reopening Baker County, we have included the Guidelines as authorized by the Oregon Health Authority and the Governor of Oregon below. We are attempting to keep this list as current as possible to assist Businesses. If you would like assistance in participating in any of these programs or have questions regarding the Guidelines, please contact our Business Liaison, Jeff Nelson 541-523-0015 or EOC@bakercounty.org. If there is no answer or you have called after normal business hours, please leave a message and your call will be returned as soon as possible. Also, if you have additional questions, you can contact our local Oregon Small Business Development Center thru Blue Mountain Community College at 541-406-4770 or jnelson@bluecc.edu or www.BizCenter.org.

- Personal Services

- Professional Services

- Restaurants

- Baker County Restaurant Meeting to discuss Phase 1 requirements hosted by Environmental Health from Wednesday, May 13, 2020, can be viewed here.

- Outdoor Recreation

- Retail Service

- Hotels-Motels

- Child Care

- Day Camps

- Fitness Centers

- Transit

The meeting held between Baker County and Businesses to discuss Phase 1 reopening instructions can be viewed here.

March 2020 Archives

Information for Restaurants and Bars

The Oregon Liquor Control Commission adopted temporary rules on March 19, 2020 that relaxes some of the requirements relating to delivery of malt beverages, wine, and cider by licensees who qualify for same day delivery, allows “curbside” delivery and simplifies the requirements regarding time and volume limits. See the resources section below for information.

Stay up to date with the latest OLCC guidance on their COVID-19 response page: https://www.oregon.gov/olcc/Pages/COVID19.aspx

Resources

Worksource Oregon

- WorkShare Oregon is a key program that helps you keep skilled employees during slow times by providing partial Unemployment Insurance benefits to supplement employees’ reduced hours.

- Another resource for small businesses and employers planning and responding to the impacts of COVID-19 is the National Business Emergency Operations Center.

The Employment Department is committed to the health and safety of our customers and the public and has created a COVID-19 Resource

Information and Resources:

Economic Injury Disaster Loan (EIDL) and Paycheck Protection Program (PPP) Information

FAQs about the recent federal aid bills from Senator Jeff Merkely

FAQs about the recent federal aid bills from Congressman Greg Walden